Real-World Home Payment Breakdown: What Online Mortgage Calculators Miss

If you’ve started looking at homes, you’ve probably done what almost every buyer does first: you opened an online mortgage calculator.

That’s not a bad thing -calculators are helpful starting points. But they’re also where a lot of confusion begins.

One of the biggest mistakes buyers make is focusing only on the home price, when in reality, the monthly payment is what you live with. And small details can change that payment more than most people expect.

Why the Home Price Isn’t the Whole Story

Two homes with the same price can have very different monthly payments.

That’s because a real mortgage payment includes more than just the loan amount and interest rate. Property taxes, homeowner’s insurance, HOA dues, and mortgage insurance can all vary depending on the home and the situation.

Online calculators often rely on estimates and assumptions. They’re not wrong – they’re just incomplete.

What Actually Goes Into a Monthly Payment

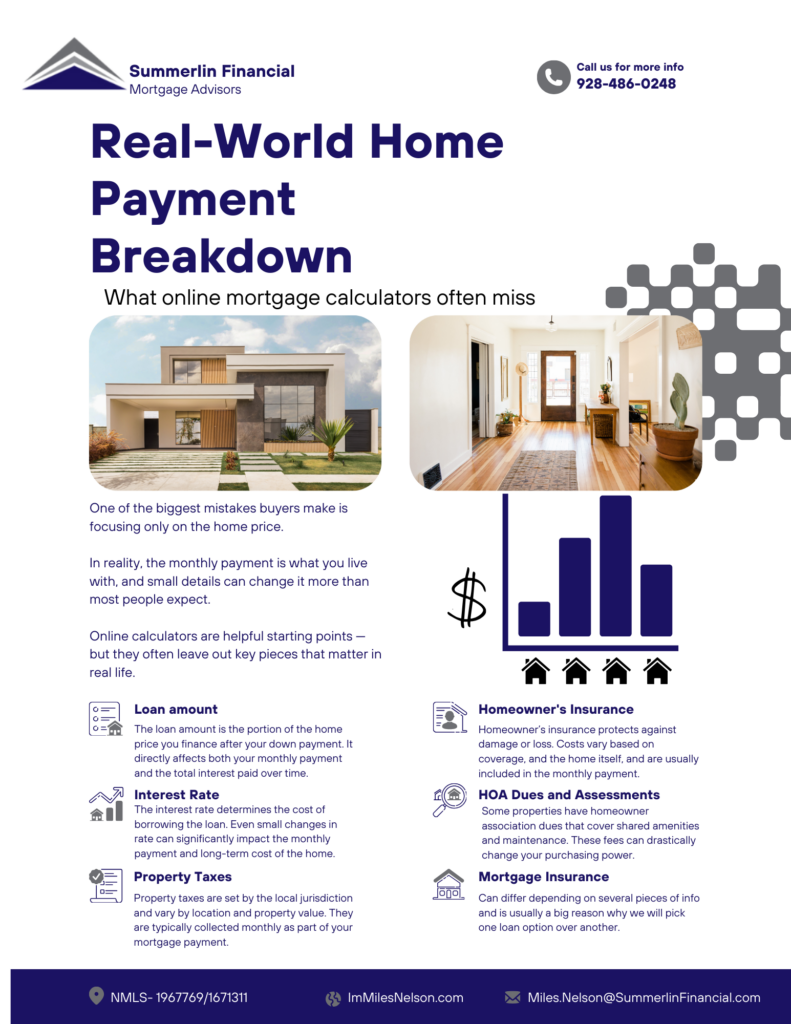

A typical monthly payment may include:

- Loan amount – the portion of the purchase price you finance after your down payment

- Interest rate – the cost of borrowing the money

- Property taxes – set by the local jurisdiction and based on the property

- Homeowner’s insurance – varies by coverage, location, and home

- HOA dues or assessments – if the property is part of an association

- Mortgage insurance – sometimes required depending on down payment and loan structure

Each of these pieces matters. Ignoring even one can give you a number that looks good on paper but doesn’t reflect reality.

Why Online Mortgage Calculators Can Be Misleading

Online mortgage calculators are designed to be quick and simple. To do that, they often:

- Estimate taxes and insurance

- Ignore HOA dues or special assessments

- Assume standard scenarios that may not apply to your situation

That’s why buyers are often surprised later – even when the home price looked affordable at first.

The Smarter Way to Look at Affordability

Instead of asking, “What’s the maximum home price I can afford?”

a better question is:

“What monthly payment feels comfortable for my life?”

When you start with the payment and work backward, buying becomes clearer and far less stressful.

Download the Real-World Home Payment Breakdown

I put together a simple, two-page guide that explains what online mortgage calculators often miss and how to think about payments in real-world terms.

👉 [Download the Real-World Home Payment Breakdown (Mortgage Guide)]

This guide is purely educational. No applications. No credit pull. Just clarity.

When Talking It Through Makes Sense

You can Google general answers all day, but those are guidelines – not advice tailored to your situation.

Some buyers choose to put more down to lower their payment. Others prefer to keep more cash available for flexibility. The right option depends on your goals, comfort level, and timing – not a one-size-fits-all rule.

If you ever want to walk through how this applies to where you are right now, I’m happy to help.

Miles Nelson, NMLS #1967769

Summerlin Financial NMLS #1671311

Equal Housing Lender

Information provided is for educational purposes only and does not constitute a loan commitment.